Cryptocurrency Exchange Development in the USA and India: How to Start and Scale a Crypto Exchange in 2025

What Is Cryptocurrency and Why Build an Exchange in the First Place?

Before you talk about cryptocurrency exchange development, you need to be absolutely clear about one basic question:

What is cryptocurrency, and why does it justify building an entire business around it?

What is Cryptocurrency?

Cryptocurrency is a digital form of money that lives on a blockchain instead of a bank ledger. Unlike a traditional bank balance, which is updated in a private database, a cryptocurrency transaction is recorded on a public or permissioned ledger that anyone can verify.

Think of Bitcoin or Ethereum as networks where thousands of computers agree on who owns what, without a central bank in the middle. A digital currency exchange or digital exchange platform sits on top of these networks and lets people buy, sell, and swap these assets.

At the user level, it feels simple:

- You open a crypto exchange account

- You deposit fiat or crypto

- You trade one asset for another on a digital currency trading platform

- The system updates your balances in real time

Behind that “simple” experience is a lot of engineering: cryptocurrency trading software development, wallet management, risk systems, and compliance. That’s what a serious cryptocurrency exchange development company deals with.

For readers who want a neutral primer on how cryptocurrencies work, Investopedia has a solid introduction.

Types of Cryptocurrency

Not all cryptocurrencies are the same. If you are building a cryptocurrency exchange, you have to decide which types you will list and support.

The main categories:

- Coins – These run on their own blockchains, such as Bitcoin (BTC) and Litecoin (LTC). If you’re asking how to create Bitcoin, the answer is: you don’t; you participate in the Bitcoin network.

- Tokens – These run on existing blockchains, like ERC-20 tokens on Ethereum. If you’re asking how to create my own cryptocoin or a cryptocurrency, tokens are often the path.

- Stablecoins – Tokens pegged to fiat, often listed heavily on any cryptocurrency exchange platforms that want to attract beginners.

- Utility/governance tokens – These can be part of your own ecosystem if, later, you decide to launch a cryptocurrency for your platform.

Founders often ask:

- Can anyone make a cryptocurrency?

- Can you create your own cryptocurrency for your project?

Technically, yes. If you know how to build cryptocurrency on top of existing networks or you work with a partner that does, you can make your own cryptocurrency contracts. The real question is whether you should, and whether it helps your business or just adds noise.

Why Build a Cryptocurrency Exchange?

So why go into the cryptocurrency business and try to start a crypto exchange at all?

There are a few rational reasons, not just hype:

- Users need a cryptocurrency-to-cryptocurrency exchange and a fiat on-ramp that is safe, regulated, and easy to use.

- Many markets still lack a trusted cryptocurrency exchange for USA beginners or a well-designed digital currency exchange in India.

- Professional traders need low-latency cryptocurrency trading software development and features they can rely on daily.

- Businesses want specialized crypto exchange solution options: P2P, OTC, or embedded trading inside their products.

If you execute well, a startup-booted crypto exchange – lean, focused, and compliance-first – can still carve out serious market share in 2025. That’s why so many founders quickly realize the exchange layer is where long-term value sits.

Advantages and Disadvantages of Cryptocurrencies

You need to understand the advantages and disadvantages before you start a cryptocurrency exchange or start trading cryptocurrency.

Advantages (why the whole space exists):

Cryptocurrencies offer:

- Open access: Anyone with an internet connection can use them. This is why onboarding flows like how to open a crypto account or why a cryptocurrency account matters so much.

- Programmability: You can create a crypto, create a crypto exchange, and even create a digital currency token that powers an ecosystem, like loyalty or governance.

- Speed and global reach: Moving value across borders can be faster than traditional banking in many cases.

Disadvantages (what you must design around):

But there are real issues:

- Volatility: Traders often underestimate price swings.

- Regulatory uncertainty: Especially in the USA and India, rules evolve quickly.

- Security risk: Poorly built systems and wallets get hacked, draining user funds.

Bloomberg and the U.S Securities and Exchange Commission often highlight real-world attacks and enforcement actions – a reminder that cryptocurrency exchange development is not a toy.

Where Exchanges Fit in this Picture

A cryptocurrency exchange acts as the bridge between:

- People who want to invest in cryptocurrency exchanges or coins, and

- The underlying blockchain networks and tokens.

In practice, your platform becomes:

- The place where users start crypto trading, and move from “I read about Bitcoin” to “I just executed my first trade.”

- The interface that answers questions like how to start trading cryptocurrency in real workflows, not just in a blog.

That’s why your cryptocurrency exchange platform development strategy must go beyond “cool charts” and focus on safety, education, and long-term trust.

Types of Exchanges, Features, and License Reality

Now that the crypto basics are clear, let’s move into what you’re actually building when you say you want to develop a cryptocurrency exchange for the USA and India.

Types of Exchanges You Can Build

When founders Google how to start a crypto exchange, they typically lump everything into one bucket. In reality, you’re choosing a model.

First, there’s the classic centralized exchange model. In centralized crypto exchange development, users deposit funds into wallets you control. You maintain an internal order book and handle matching, settlement, and reporting. This is the most common approach for startup crypto exchanges aiming to be the best beginner cryptocurrency exchange in a region like the US.

Then there is P2P crypto exchange development, where users trade directly with each other, and you provide the platform, escrow, and dispute tools. P2P can be attractive when you’re targeting markets like India with strong demand for fiat-to-crypto ramps but complex legacy banking rails.

A third path is OTC crypto exchange development. In this setup, a bespoke desk negotiates large trades for high-net-worth clients and institutions. If you plan to build this, working with an experienced OTC crypto exchange development company makes sense.

Finally, some teams explore open source crypto exchange engines and attempt to adapt them. This can help with learning and prototyping, but security, compliance, and cryptocurrency exchange scalability remain 100% your responsibility.

Build vs White Label vs Hybrid: Choosing Your Development Path

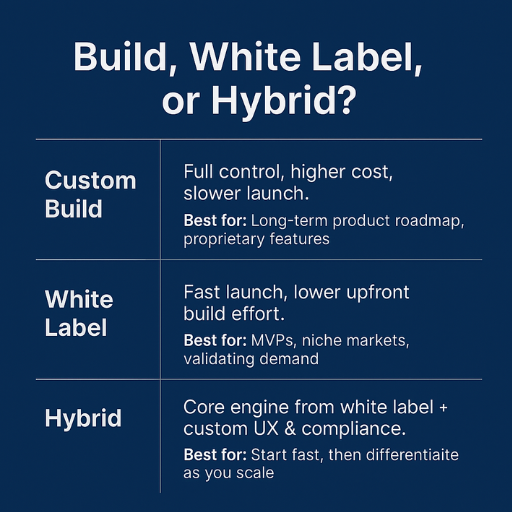

Once you know what kind of exchange you want to launch and how the core architecture should look, you still have one big decision left: how you’ll actually build it. Most founders assume there are only two choices – either build everything from scratch or buy a complete “exchange in a box”. In reality, serious teams usually end up somewhere in the middle.

A custom build gives you full control over the product. You can design your own trading engine, onboarding flows, risk rules, and admin tools instead of working around someone else’s limits. This path is ideal if you see your exchange as a long-term product with a strong roadmap, or if you need features that generic platforms don’t support. The downside is obvious: higher upfront cost, longer timelines, and the need for a strong in-house team working with a seasoned cryptocurrency exchange development company.

A white label cryptocurrency exchange development approach sits at the other extreme. Here, you license an existing engine and user interface from a vendor, plug in your branding, configure pairs and fees, and launch. It’s faster and can be cheaper upfront, which is why a lot of startup crypto exchanges go this route for an MVP. But you’re tied to the vendor’s roadmap, performance ceilings, and security choices, and you may hit walls when you want to differentiate your product or expand into new markets like the USA and India.

The hybrid model is usually the most practical for founders who want both speed and control. In this setup, you use white label or pre-built modules for the hardest low-level pieces – for example, the matching engine or wallet infrastructure – and then invest in custom work for everything your users actually see and regulators actually care about. That means tailored onboarding, region-specific KYC, reporting, and mobile apps built with your own UX, powered by a crypto exchange software development partner who understands how to build crypto exchange features that can evolve.

If you think about this choice early and honestly – budget, timeline, and internal skills on the table – you’re much less likely to end up with a “launched” exchange that you can’t really improve or scale.

Core Features a Modern Crypto Exchange Needs

Regardless of your chosen model, a serious cryptocurrency exchange platform needs to deliver a stable, secure flow from sign-up to trade.

At a minimum, think in terms of three layers.

First, the user layer: registration, login, KYC, and onboarding. This is where people search “how to open a cryptocurrency account” and expect something clean and intuitive. You must answer those questions inside the product: guidance, error messages, and walkthroughs.

Second, the trading layer: order placement, order book display, history, positions, and P&L. This is where cryptocurrency trading software development matters. If orders freeze or trades mis-execute, your support inbox and reputation are dead on day one.

Third, the wallet and settlement layer: deposits, withdrawals, internal transfers, and hot/cold storage. This is where you integrate with blockchain nodes, on-chain monitoring, and risk systems. A lot of the real-world engineering in cryptocurrency exchange software development sits here, not in the charts.

Around those layers, you need admin tools, risk dashboards, AML monitoring, and reporting – especially if your long-term plan includes cryptocurrency exchange no fees promotions or the cheapest crypto swap exchange marketing. Those offers are only sustainable if your core numbers and risk indicators are solid.

Exchange Licenses: USA and India

You can’t talk about how to start a cryptocurrency exchange without facing licensing.

In the United States, a typical path involves registering as a Money Services Business (MSB) with FinCEN and obtaining state-level money transmitter licenses, depending on your footprint and model. If you list certain instruments, you may also trigger securities or derivatives regulation.

In India, exchanges are expected to register as Virtual Digital Asset Service Providers with FIU-IND and follow AML and PMLA obligations. If you’re planning cryptocurrency exchange development in the USA as primary and India as secondary, you’ll be operating across two very different but equally serious regimes.

This is where legal counsel and compliance specialists matter just as much as crypto exchange developer hires. Ignoring this because you’re “just a startup” is how starting a crypto exchange turns into “getting shut down”.

Advantages and Disadvantages of Running an Exchange

At the business level, what are you really getting into when you decide to build a cryptocurrency exchange?

On the plus side, if you execute well:

- You become the default answer when beginners search for how to invest in cryptocurrency exchanges in your region.

- You build a recurring revenue machine via trading fees, spreads, and premium services.

- You create a platform where you might later launch a crypto coin or token with genuine utility.

On the negative side:

- You take on operational risk: outages, support load, and technical incidents.

- You take on regulatory and reputational risk in two very strict markets (the USA and India).

- You must fund continuous cryptocurrency exchange software development, audits, and feature updates.

If your goal is fast cash, DeFi farming or short-term trading is easier. If your goal is a multi-year crypto business, build a crypto exchange with a long-term mindset.

Mobile, Web, and Where Users Actually Trade

There’s another basic decision you must make early: where will your users trade most – mobile app or web app?

In the US and India, a large part of your traffic will be mobile. That means strong cryptocurrency app development, not just a responsive website. You should read Mobile App vs Web App and Mobile App Development Cost in the USA.

These will help you weigh mobile app vs web app choices, and budget realistically for the mobile side of your cryptocurrency trading software development.

If you’re leaning mobile-first, make sure you also avoid the usual product traps founders fall into – we’ve broken them down in detail in our guide to the Top 10 mistakes startups make when developing their app.

Many successful exchanges start by focusing sharply on one side, then expand. For example, start with a fast, clean web trading platform targeting desktop users, then roll out mobile once feedback stabilizes; or the opposite if your research says your primary user persona is mobile-only.

From Idea to Launch: Working With a Development Company You’ve Actually Researched

Now we get to the part most founders rush: how to actually develop the exchange and who should build it.

Plenty of people Google phrases like how to create a crypto exchange and assume a few tutorials will get them there. That’s naive. You’re not just writing a landing page; you’re designing a system where real people store money.

DIY vs Development Partner (Reality Check)

If you already have a strong in-house team with experience in cryptocurrency trading software development, custody, and high-availability systems, you might have a shot at building the core stack yourself. Even then, you’ll often bring in external specialists for audits or specific modules.

If you don’t, then partnering with a cryptocurrency exchange development company is far more realistic. This is where you absolutely must research the company online instead of just going with the cheapest quote.

Typical Development Path with a Partner

Assume you’ve selected a partner after proper online research. A realistic development journey often looks like this:

You begin with discovery. Here, you map your target markets (US and India), user segments, and feature set. You choose whether to emphasize P2P, CEX, or OTC in your first version. This is where decisions around starting a cryptocurrency exchange vs starting a cryptocurrency coin get resolved.

Next comes architecture and prototyping. Your partner defines how your cryptocurrency exchange platform development will be structured: services, databases, wallets, monitoring, and integrations. You get initial flows for onboarding, KYC, trading, and withdrawals so you can validate that it actually aligns with what your users expect.

Then the core build begins. This includes:

This is where all those small but important phrases become concrete tasks, not just marketing language.

After that comes testing and security review. You need functional tests, load tests, and security assessments. A proper cryptocurrency exchange company will insist on this phase instead of rushing straight to launch.

Finally, you go into beta, refine based on user feedback, and then launch publicly with controlled limits. At each step, you keep one eye on your regulatory obligations and one eye on user experience.

- Backend modules for accounts, wallets, and trading

- Frontend for web and, later, mobile

- Integrations with payment gateways and liquidity providers

This is where all those small but important phrases become concrete tasks, not just marketing language.

After that comes testing and security review. You need functional tests, load tests, and security assessments. A proper cryptocurrency exchange company will insist on this phase instead of rushing straight to launch.

Finally, you go into beta, refine based on user feedback, and then launch publicly with controlled limits. At each step, you keep one eye on your regulatory obligations and one eye on user experience.

Where Your Own Token Fits In

Many founders obsess over how to start a cryptocurrency coin while their core exchange product is still half-baked.

A more grounded sequence is:

- Launch the exchange, get real usage, and prove you can operate.

- Add features users actually request: better charts, lower fees, improved onboarding.

- Only then consider whether creating cryptocurrency or a loyalty token would genuinely improve retention or fee economics.

If you do go that route, you might explore:

- How to create a crypto token on Ethereum or similar

- How to make your own cryptocurrency coin with audited smart contracts

- How to launch a crypto coin in a way that is transparent and compliant

But this should be the third or fourth step, not the first

Bringing It All Together

Building a serious cryptocurrency exchange in 2025 isn’t about chasing the latest coin narrative or launching a token before you even have users. It’s about understanding what cryptocurrency is, choosing the right exchange model, respecting regulation in markets like the USA and India, and partnering with a team that can actually ship and maintain the platform. If you get those fundamentals right, you can always add more trading pairs, new features, or even your own token later.

If you’re at the “thinking about it seriously” stage, your next step is simple: write down your target market, core features, and risk appetite on one page, then speak with a development partner who has already gone through this journey with other exchanges. That conversation will clarify very quickly what’s realistic for your budget, timeline, and ambition.

FAQ: Cryptocurrency Exchange Development

What is a cryptocurrency exchange, and how does it work?

A cryptocurrency exchange is an online platform where users can buy, sell, and trade digital assets like Bitcoin or Ethereum. Users deposit fiat or crypto, place buy/sell orders, and the exchange’s matching engine pairs those orders and updates balances. Behind the scenes, the exchange manages wallets, order books, KYC/AML checks, and integrations with banks and blockchain networks.

How much does it cost to build a cryptocurrency exchange?

Costs vary widely depending on the scope. A serious MVP using white-label components can still run into six figures (USD) when you include licensing, compliance, development, security, and infrastructure. A fully custom, high-performance platform with mobile apps, advanced features, and global scalability often costs significantly more and requires ongoing OPEX for engineering, support, and legal.

Should I use white label crypto exchange software or build from scratch?

White-label solutions are faster to launch and can be cheaper upfront, which is useful for MVPs and niche markets. Building from scratch gives you full control over features, performance, and security, and avoids vendor lock-in – but it requires more time, money, and in-house expertise. Many founders use a hybrid approach: white label for core trading engine, with custom onboarding, mobile apps, and compliance workflows.

Is it legal to run a cryptocurrency exchange in the USA and India?

In both the USA and India, running a cryptocurrency exchange can be legal if you comply with the applicable regulations. In the USA, that means FinCEN registration, state licensing where required, and adherence to securities/commodities laws where relevant. In India, that means FIU-IND registration, AML compliance, and following tax and reporting rules. Operating “under the radar” is not a viable long-term strategy.

Can I create my own cryptocurrency and list it on my exchange?

Yes, technically yo,u can create your own token or coin and list it on your exchange, but it adds legal, reputational, and technical complexity. You need to consider whether the token might be treated as a security, how you’ll structure its economics, and how you’ll avoid conflicts of interest with your users. Most serious founders focus on launching a stable, compliant exchange first and only introduce a native token later, if it has clear, defensible utility.

Do I need mobile apps for my crypto exchange?

If you are targeting retail users in markets like the USA and India, a strong mobile experience is almost mandatory. Many users will do most of their trading on smartphones, not desktops. You can launch web-only first, but you should plan for iOS and Android apps early and budget for proper product design and QA. Avoid the common pitfalls outlined in your internal guide to the top 10 mistakes startups make when developing their Android app.